Unizen solves Swap Execution Failures in DeFi

Solving Swap Execution Failures in DeFi

Every second, thousands of DeFi swaps fail. Users lose gas, trust erodes and protocols take the hit.

You click “Swap.” Everything looks good. The wallet confirms. Gas is spent. But the trade doesn’t go through. No tokens received. Just a “transaction reverted” message… and a few dollars burned forever.

Welcome to one of DeFi’s worst-kept secrets: swap execution failures.

These aren’t isolated bugs. They’re systemic. It can happen whether you’re swapping through a wallet, a DEX aggregator, or or a DEX, the risk is always there. Failed trades happen when malicious token logic, insufficient liquidity, or broken smart contracts interfere with the swap after the quote is shown but before it’s executed.

This results in:

- "Transaction reverts" — the swap fails mid-execution.

- "Dry txs" — you pay gas, but receive nothing.

- "False positive quotes" — a route looks viable but is doomed from the start.

It’s a silent tax on DeFi users. Most platforms just accepted it as part of the cost of being decentralized.

But we didn’t. At Unizen, we’ve spent months tackling this head-on, and we’ve built a breakthrough that could redefine the baseline for swap reliability in DeFi.

What Causes Swap Failures in DeFi?

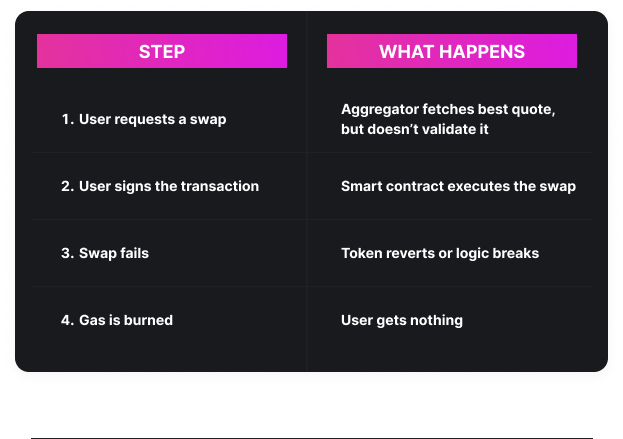

To understand why DeFi swaps fail, we need to look under the hood of how aggregators and wallets work.

When a user initiates a trade, the DEX aggregator fetches live quotes from various decentralized exchanges (AMMs, PMMs, custom liquidity pools). It then selects the route that offers the best token output and shows it to the user. But the catch is, those quotes are only estimates.

There’s no guarantee the swap will succeed… and in many cases, it doesn’t.

Common Causes of Failed Trades

1. False Positive Quotes

These are quotes that appear valid but will fail if actually executed. The route looks good on paper, but behind the scenes it’s broken. This could be due to a scam token, outdated liquidity, or faulty smart contract logic. These are especially dangerous because they lure the user into confirming a doomed transaction.

2. Transaction Reverts

When a smart contract “reverts” mid-transaction, the trade halts and the user’s gas is still consumed. This is known as a swap execution failure. Reasons include:

- Tokens that don’t conform to ERC-20 standards

- Tokens that revert when sent to routers

- Dynamic pricing or slippage that makes the trade invalid during confirmation

3. Dry TX (Dry Transactions)

The worst-case scenario: the user pays gas, but nothing happens. No tokens are received. No swap is executed. It’s a dry tx, and it leaves users confused, frustrated, and financially worse off.

It’s Not Just a “User Problem”

Failed trades don’t just hurt end-users, they hurt platforms too:

- Wallets get support tickets and lose trust

- Aggregators lose credibility and conversion

- CEXs integrating DeFi (like Bitget) see degraded UX and halted rollouts

- Builders waste engineering hours debugging what should’ve been a routine swap

Most platforms accept this friction as a trade-off for decentralization. The solution is to simulate token swaps before execution, but this has historically been too slow to be practical.

Why Other Aggregators Can’t (or Don’t) Solve This

DEX aggregators compete on speed by fetching thousands of quotes per second, racing to deliver “the best price.” However, some of these routes may actually be unreliable or outright invalid, leading to failed transactions. So why don’t they just simulate the swap first? Because this can cost them precious time in delivering the quote to the user.

The Simulation Bottleneck

Simulating a token swap means emulating the smart contract logic to see if the trade would succeed before actually executing it on-chain. It’s the only way to detect honeypots, reverts, or faulty ERC-20 logic in advance.

But traditional swap simulations can take over 1 second, which is far too long to support real-time quoting in competitive environments like meta-aggregators or high-traffic wallets. As a result, most aggregators skip simulation entirely.

The result is:

This leads to:

- False positive quotes being served

- Swap execution failures

- Dry txs that waste gas

Why This Hurts Integrators

For integrators, especially wallets, protocols, and exchanges, failed trades are a UX nightmare:

- Users blame the platform, not the token

- Support costs rise

- Conversion drops

- Institutional partners (like CEXs) reconsider DeFi integrations

No aggregator has solved this. Most have accepted it as “the cost of doing business in DeFi.”

But at Unizen, we decided that wasn’t good enough.

How Unizen Solves It With Sub-Second Swap Simulation

After running into swap execution failures firsthand our engineering team doubled down. We tested every third-party token simulation service on the market. All of them were too slow. Simulations took over 1 second on average, which is far too slow to support real-time quoting at scale…. So we built our own.

From 1 Second to 30 Milliseconds

Using a fully in-house simulation engine, we slashed simulation times down to just 30ms without sacrificing accuracy or coverage. That’s fast enough to validate every quote we serve in real-time, across thousands of requests per second.

This breakthrough means:

- Every swap quote is pre-simulated before it’s shown to the user or integrator

- If a trade is likely to fail, we don’t quote it

- No more false positives

- No more dry transactions

- No more wasted gas

It’s a powerful form of predictive execution, and it adds a critical layer of reliability that’s been missing from the DeFi stack until now.

DeFi Execution at Web2 Speed

With our new swap simulation layer in place, Unizen is setting a new standard for DeFi transaction reliability. For the first time, integrators and users can expect:

- Near-instant quotes

- Guaranteed execution

- Zero failed swaps served

This sets a new benchmark for wallets, DEX frontends, and institutional players demanding reliability in a decentralized world.

This is the Web2-grade reliability DeFi has been waiting for.

What This Unlocks for Integrators, Wallets, and Users

Unizen’s swap simulation engine addresses one of the most persistent blockers to DeFi adoption: unreliable trade execution.

By validating every quote in milliseconds, it brings a new level of trust and predictability to the entire ecosystem.

For Users:

- No more gas lost on failed trades

- No more confusing reverts or empty confirmations

- More confidence in every swap (especially across chains)

This leads to a better experience, higher trust, and more frequent engagement. Users stay. They swap more. And they don’t churn from broken experiences.

For Wallets:

- Fewer failed trades means fewer support tickets

- Cleaner UX means higher retention and better reviews

- A competitive edge: now you can offer “execution-assured swaps”

Now you can offer reliability, and that’s what users come back for.

For Integrators of All Kinds:

- No more false quotes

- No more backend trade errors

- Just clean, validated execution across chains and tokens

Unizen’s API now offers predictive execution and quote validation out of the box, no extra dev work required.

“With this solution, we’ve reached enterprise-grade reliability. Which opens the door to deeper integrations across the DeFi landscape.”

Martin Granström, Unizen CTO

A New Standard in DeFi Execution

Failed trades have been silently draining trust from DeFi for years.

Users losing gas. Wallets dealing with frustration. Aggregators pushing unvalidated quotes. CEXs hesitating to take the leap into Web3 rails. All because no one could reliably simulate swaps at scale… until now.

Unizen’s breakthrough in sub-second swap simulation isn’t a nice-to-have. It’s a new baseline for what DeFi execution should look like.

No more dry txs. No more false quotes. No more excuses.

We shouldn’t have to tolerate failure as a feature of decentralized finance.

Ready to experience it?

We’re rolling out predictive execution and quote validation — soon available on: https://zcx.com.

Developers and integrators can get ahead of the curve by exploring our API:

https://docs.unizen.io/api-introduction/introduction

The next generation of DeFi infrastructure is here, and every quote we serve comes with one promise:

It will execute.